MONDAY MARKET UPDATE SEPTEMBER 26, 2022

SUMMARY

The selloff we saw across both stock and bond markets last week were the result of hawkish actions and Fed-speak from FOMC Chairman Jerome Powell. The reaction by the markets caused our Catastrophic Stop model to turn bearish, which resulted in our Smart Sector Strategy going to 50% cash. This change was enacted in client accounts that are invested in that strategy and that own our exchange-traded fund.

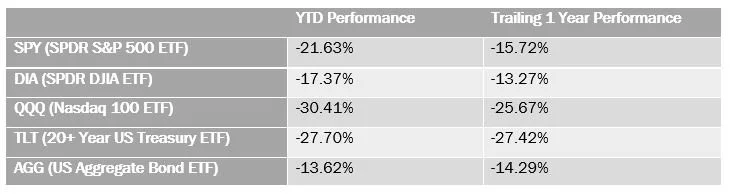

Following the Fed meeting and result, the S&P 500 marched back down to the calendar-year lows seen in mid-June. As the table below illustrates, there have been very few places to hide this year, as nearly all major asset classes are mired in bear markets.

BROAD MARKET PERFORMANCE (AS OF 9/23/2022)

Source: ETFdb.com

MACROECONOMIC VIEW

As mentioned last week, we continue to monitor the inflation data, but signs are pointing to moderation on that front. With that being said, the Fed’s extremely hawkish monetary policy is working as they intended; rapidly slowing down the economy. The Leading Economic Index (Figure 1) peaked in February, has been falling for the past six months, and has had the steepest drop since August of 2020.

Figure 1: NDR Index of Coincident Economic Indicators

VALUATIONS

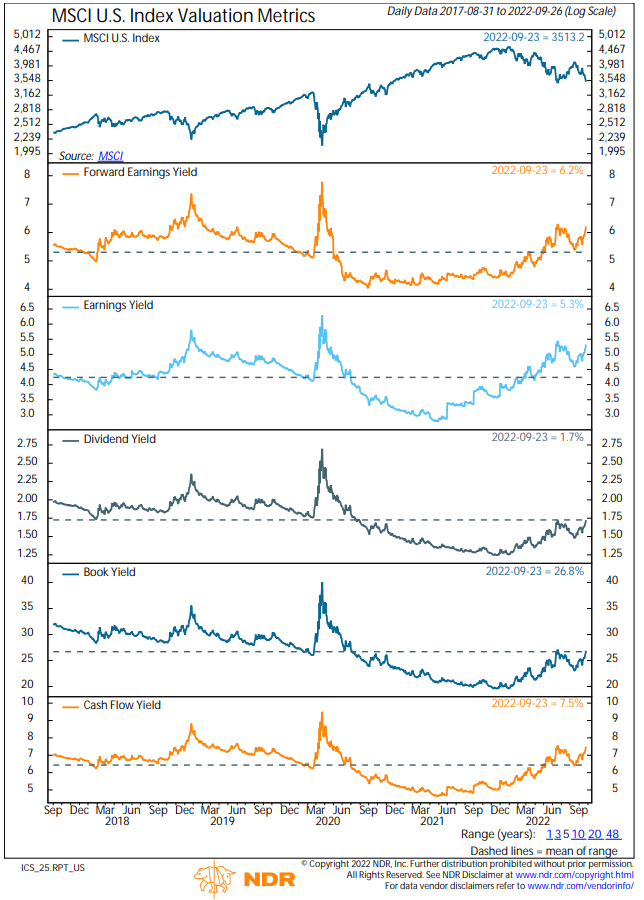

After the market’s selloff at the end of last week, the broader markets are nearing normal valuation levels and are beginning to show signs of being slightly undervalued (Figure 2). Forward (Expected) Earnings Yields, Earnings (Reported) Yields, and Cash Flow Yields are all above their 5-year averages. However, this will only hold true if earnings estimates hold up, which we aren’t convinced will happen. Earnings are expected to increase 14.6% in 2023, but earnings have declined 20% on average during recessions. Therefore, if we are in a recession, which we view as highly possible, earnings forecasts are too high and will likely have to come down.

When evaluating yields, keep in mind that higher is better. We note that Dividend and Book Value yields are still below their historical averages. However, the world has changed and companies are 1) less inclined to pay dividends and 2) their tangible book values do not include intangible assets, which have become a larger part of a company’s overall value during the age of tech. All in all, the markets are trading nearer to historical measures of fair value, which have often provided longer-term support—as long as earnings hold.

Figure 2: U.S. Index Valuation Metrics

TECHNICALS/SENTIMENT

Given the market’s reaction to the Fed statement last week, the short-term trend indicator that we use in our Catastrophic Stop model for the Smart Sector strategy turned bearish. This caused us to raise our cash position to 50% within the Smart Sector strategy. For those of you who are invested in this strategy and did not receive the trade notification last week, you can read it here.

Figure 3: Catastrophic Stop Model Short-Term Trend Indicator

After the market selloff last week, investor sentiment fell even more into the excessive pessimism zone (Figure 4). From a contrary opinion perspective, this has historically been a bullish support. The great investor Warren Buffett famously quipped, “Be fearful when others are greedy. Be greedy when others are fearful.” The NDR Crowd Sentiment Poll is in the midst of its third-longest stretch of extreme pessimism since 1995. After exiting previous long periods of pessimism, the stock market has been in a cyclical bull. It has paid to wait for pessimism to reach an extreme and reverse before turning bullish.

Figure 4: NDR Sentiment Index

Overall, after the Fed’s extremely hawkish tone in their meeting last week, the market’s reaction has caused the models to turn more bearish. The Catastrophic Stop Model used in our Smart Sector (SPDR ETFs) strategy caused us to go to 50% cash within that portfolio. Our Smart Value (individual stocks) portfolio continues to hold an elevated level of cash while being invested in companies that are generating high levels of cash and have pristine balance sheets. The buffered ETFs within the Defined Outcome strategy continue to reduce volatility and are performing as we would expect given turbulent markets. While the Fed’s interest rate policy has caused volatile markets, it has also presented some new opportunities. Interest rates have increased to levels that have started to become attractive, as we are now seeing 2-year Treasury bonds yielding around 4.25%. Please give us a call if you would like to discuss these any further.

Have a great week,

Regan Teague, CFA®, CFP®

Senior Investment Officer & Financial Advisor

Day Hagan Private Wealth

—Written 09.26.2022.

Print PDF Copy of the Article: Day Hagan Private Wealth Market Update: Monday Market Update (pdf)

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Private Wealth (DHPW), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Private Wealth literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHPW accounts that DHPW or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member FINRA, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management and Day Hagan Private Wealth are both dbas of Donald L. Hagan, LLC.