INFLATION, RATES, AND RECESSION RISKS PUSH STOCKS AND BONDS LOWER IN Q2

SUMMARY

The same headwinds that pushed stocks and bonds lower in the first quarter of 2022 continued in the second. However, the S&P 500 now sits at much more historically normal valuation levels, with at least some of the negative news already priced in, leaving potential for positive surprises.

MULTIPLE FACTORS CONTINUE PRESSURING MARKETS

The S&P 500 continued to decline in the second quarter, hitting the lowest level since December 2020 as still-high inflation, sharp increases in interest rates, rising recession risks, and ongoing geopolitical unrest pressured stocks and other assets.

After a rebound in March, the S&P 500 dropped sharply in April to start the second quarter. While some of the reasons for the declines were similar to the first quarter (rising rates, high inflation, geopolitical concerns) the primary catalyst for the April sell-off was something new: a massive COVID-related lockdown in China. Unlike most of the rest of the world, China continues to enforce a “Zero-COVID” policy, whereby small outbreaks are met with extremely intense city- and province-wide lockdowns. At the peak of the recent COVID outbreak and subsequent lockdowns throughout China, it was estimated that 46 separate cities and provinces, impacting 300 million people and representing nearly 80% of China’s economic output, were shut in and shut down, essentially halting the world’s second-largest economy. This sharp drop in economic activity not only increased the chances of a global recession but also compounded global supply chain problems (Shanghai, the world’s busiest port, operated far below capacity during the lockdowns). The severe decline in economic activity in China combined with lingering concerns about rising interest rates and high inflation hit stocks hard in April, and the S&P 500 fell 8.7%.

The selling continued in early May, as the Federal Reserve raised interest rates by 50 basis points at the May 4 meeting, the single-biggest rate hike in 22 years. Additionally, at the press conference, Fed Chair Jerome Powell’s clear signal that the Fed would continue to hike rates aggressively to tame inflation weighed on stocks, pressuring the S&P 500 to fall to new 2022 lows in mid-May. But towards the end of the month, markets staged a modest rebound thanks to potential improvement in multiple market headwinds. First, as COVID cases declined, the Chinese economy started to reopen, and by the end of May, the port of Shanghai was operating at 80% capacity, a material improvement from earlier in the month. Additionally, Atlanta Fed President Raphael Bostic stated that the Fed might “pause” rate hikes in the late summer or early fall, and that gave investors some hope that the end of the Fed rate hike cycle may be closer than previously thought. Finally, some inflation metrics implied price pressures may be peaking. Those potential positives, combined with deep, short-term oversold conditions in equity markets, prompted a solid rally in late May, and the S&P 500 finished the month with a fractional gain.

But the relief didn’t last long. On June 10, the May CPI report showed inflation had not yet peaked as CPI rose 8.6% year-over-year, the highest reading since 1982. That prompted a violent reversal of the late-May gains, and the selling and market volatility was compounded when the Federal Reserve increased interest rates by 75 basis points on June 15, the biggest rate hike since 1994. Additionally, Fed Chair Powell again warned that similar rate hikes are possible in the coming months. The high CPI reading combined with the greater-than-expected rate hike hit stocks hard, and the S&P 500 dropped sharply in mid-June to its lowest level since December 2020. During the last two weeks of the quarter, markets stabilized as commodity prices declined while U.S. economic readings showed a clear moderation in activity. That rekindled hope that a peak in inflation and an end to the rate hike cycle might come sooner than feared. Those factors, combined with the fact that markets had become near-term oversold again, resulted in a modest bounce late in the month, but the S&P 500 still finished with a solidly negative return for June.

In sum, the factors that pressured stocks in the first quarter, including high inflation, the prospect of sharply higher interest rates, geopolitical unrest, and rising recession fears, also weighed on stocks in the second quarter. Until investors get relief from these headwinds, markets will remain volatile.

SECOND QUARTER PERFORMANCE REVIEW

All four major stock indices posted negative returns for the second straight quarter, and like in the first quarter, the tech-heavy Nasdaq underperformed primarily thanks to rising interest rates while the Dow Jones Industrial Average relatively outperformed. Also, like the first quarter, rising rates and growing fears of an economic slowdown fueled the continued rotation from high valuation, growth-sensitive tech stocks to sectors of the market that are more resilient to rising rates and slowing economic growth.

By market capitalization, large-cap stocks again outperformed small-cap stocks in the second quarter, although the performance gap was small. Large-cap outperformance continued to be driven by the rise in interest rates as well as growing recession fears. Small-cap stocks are typically more reliant on debt financing to sustain their businesses and therefore more sensitive to rising interest rates than large-cap stocks. Additionally, investors again moved to the relative safety of large caps amidst rising risks of a future slowing of economic growth or recession.

From an investment style standpoint, both value and growth registered losses for the second quarter, a departure from the first quarter where value posted a positive return. However, value did again handily outperform growth on a relative basis in the second quarter. Rising interest rates, still-high inflation, and increasing recession concerns caused investors to continue to flee growth-oriented tech stocks and rotate to more fairly valued sectors of the market, although again, both styles finished the quarter with negative returns.

On a sector level, all 11 S&P 500 sectors finished the second quarter with negative returns. Relative outperformers included traditionally defensive sectors such as utilities, consumer staples, and healthcare, which are historically less sensitive to a potential economic slowdown, and the quarterly losses for these sectors were modest. Energy was also a relative outperformer thanks to high oil and gas prices for much of the second quarter, although a late-June drop in energy commodities caused the energy sector to finish the quarter with a small loss.

Sector laggards in the second quarter were similar to those in the first quarter, with communication services, tech, and consumer discretionary sectors seeing material declines due to the aforementioned broad rotation away from the more highly valued corners of the market. Specifically, internet stocks again weighed on the communications sector, while traditional retail stocks were a drag on the consumer discretionary sector following unexpectedly bad earnings from several major national retail chains. Financials also lagged in the second quarter thanks to rising fears of a future recession combined with a flattening yield curve, which can compress bank profit margins.

| US Equity Indexes | Q2 Returns | YTD |

|---|---|---|

| S&P 500 | -17.41% | -19.96% |

| DJ Industrial Average | -12.17% | -14.44% |

| NASDAQ 100 | -23.50% | -29.22% |

| S&P 500 MidCap 400 | -16.62% | -19.54% |

| Russell 2000 | -18.02% | -23.43% |

| Table 1: U.S. Equity Indexes Q2 Returns and YTD Returns. Source: YCharts. | ||

Internationally, foreign markets declined in the second quarter as the Russia-Ukraine war continued with no signs of a ceasefire in sight. However, foreign markets relatively outperformed U.S. markets as foreign central banks are expected to be less aggressive with future rate increases compared to the Fed. Emerging markets outperformed foreign developed markets thanks to high commodity prices (for most of the quarter) and despite rising global recession fears.

| International Equity Indexes | Q2 Return | YTD |

|---|---|---|

| MSCI EAFE TR USD (Foreign Developed) | -15.15% | -19.25% |

| MSCI EM TR USD (Emerging Markets) | -11.92% | -17.47% |

| MSCI ACWI Ex USA TR USD (Foreign Dev & EM) | -14.34% | -18.15% |

| Table 2: International Equity Indexes Q2 returns and 2022 Returns. Source: YCharts. | ||

Commodities registered slightly negative returns in the second quarter thanks mostly to steep declines in late June. Fears of a global recession hit most commodities at the end of the quarter and erased what was, up to that point, a solidly positive performance for the broader commodity complex. Oil finished the quarter with a small loss. Prior to late June, oil prices were sharply higher for the quarter, but rising fears of reduced future demand and increased supply weighed on the oil market into the end of the quarter. Gold, meanwhile, logged solidly negative returns despite the increase in market volatility and multidecade highs in inflation, as the strong dollar and rising real interest rates weighed on the yellow metal.

| Commodity Indexes | Q2 Return | YTD |

|---|---|---|

| S&P GSCI (Broad-Based Commodities) | -1.62% | 35.80% |

| WTI Crude Oil | -1.78% | 41.43% |

| Gold Price | -5.88% | -1.28% |

| Table 3: Commodity Indexes Q2 returns and YTD Return. Source: YCharts/Koyfin.com | ||

Switching to fixed income markets, most bond indices registered solidly negative returns. Shorter-term Treasury Bills again outperformed longer-duration Treasury Notes and Bonds as high inflation and the threat of more than previously expected Fed rate hikes weighed on fixed income products with longer durations. Short-term Treasury Bills finished the quarter with a slightly positive return.

Corporate bonds underperformed in the second quarter as rising recession fears paired with already-high inflation weighed considerably on corporate debt. For much of the quarter, high-quality investment-grade bonds and lower-quality high yield corporate bonds had similar negative returns, implying investor concerns about a future recession were general in nature. However, an increase in disappointing economic data hit high-yield corporate bonds at the end of the quarter and they underperformed their higher-quality counterparts.

| US Bond Indexes | Q2 Return | YTD |

|---|---|---|

| BBgBarc US Agg Bond | -4.63% | -10.35% |

| BBgBarc US T-Bill 1-3 Mon | 0.12% | 0.16% |

| ICE US T-Bond 7-10 Year | -4.00% | -10.53% |

| BBgBarc US MBS (Mortgage-backed) | -3.98% | -8.78% |

| BBgBarc Municipal | -2.77% | -8.98% |

| BBgBarc US Corporate Invest Grade | -7.16% | -14.39% |

| BBgBarc US Corporate High Yield | -9.78% | -14.19% |

| Table 4: U.S. Bond Indexes Q2 Returns and YTD Return. Source: YCharts. | ||

THIRD QUARTER MARKET OUTLOOK

The S&P 500 just realized its worst first-half performance since 1970 as initial market headwinds of high inflation and sharply rising interest rates combined with growing recession risks and extreme geopolitical uncertainty pushed stocks and bonds sharply lower through the first six months of the year. Looking back to 1961, this was the first time in history that Treasuries, as measured by the 20+ Year Treasury Bond index, had nearly the same drawdown as the S&P 500.

Figure 1: Cumulative performance of the 20+ Year Treasury Bond Index vs. the S&P 500 Total Return.

Those declines are understandable considering inflation reached a 40-year high, the Federal Reserve raised interest rates at the fastest pace in decades, the world’s second-largest economy effectively shut down, and the Russia-Ukraine war continuing.

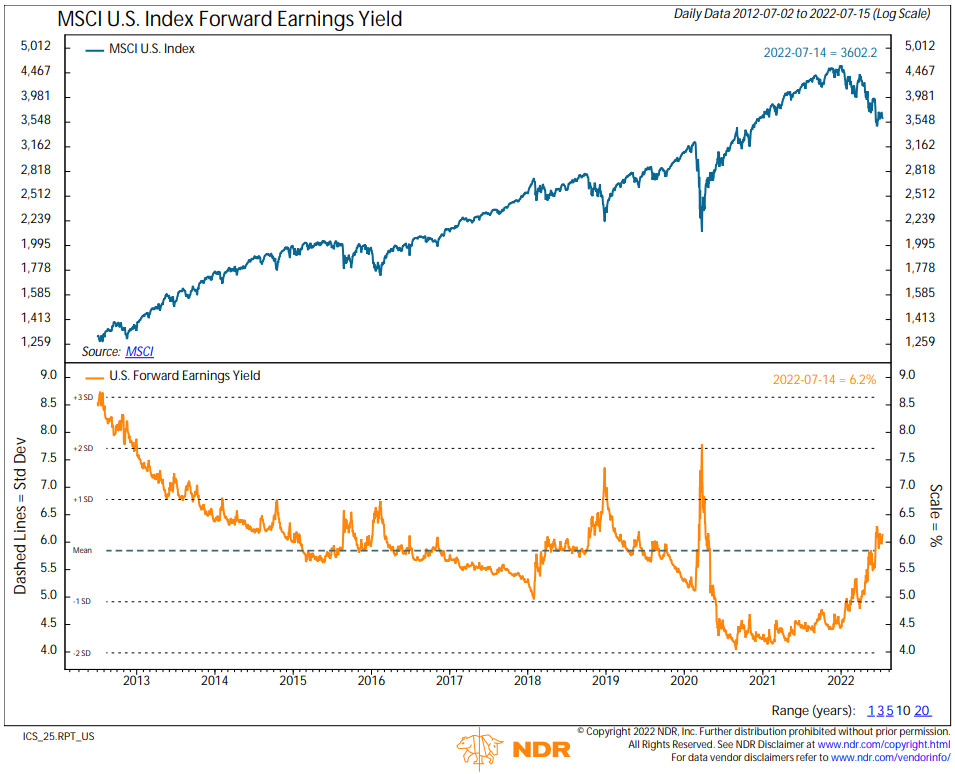

But while the volatility and market declines of the first six months of 2022 have been unsettling and painful, the S&P 500 now sits at much more historically normal valuation levels as indicated by the forward earnings yield (higher is better). And it is in our opinion that at current prices, a lot of negativities have been priced into the market, opening the possibility of positive surprises as we move forward in 2022.

Figure 2: MSCI U.S. Index Forward Earnings Yield

Regarding inflation and Fed rate hikes, markets have aggressively priced in stubbornly high inflation and numerous additional rate hikes from the Federal Reserve between now and the end of the year. But if we see a definitive peak in inflationary pressures in the coming months, then it’s likely the Federal Reserve will hike rates less than currently feared, and that could be a materially positive catalyst for markets.

On economic growth, the Chinese economic shutdown has increased global recession concerns, but recently officials in Shanghai declared “victory” against the latest COVID outbreak and if Chinese economic activity can return to normal, that will be a positive development for global economic growth. Meanwhile, recession fears are rising in the U.S., but stocks are no longer richly valued, and as such, aren’t as susceptible to an economic slowdown as they were at the start of the year. With that being said, we are closely watching earnings revisions and management’s second half outlooks as we enter earnings season.

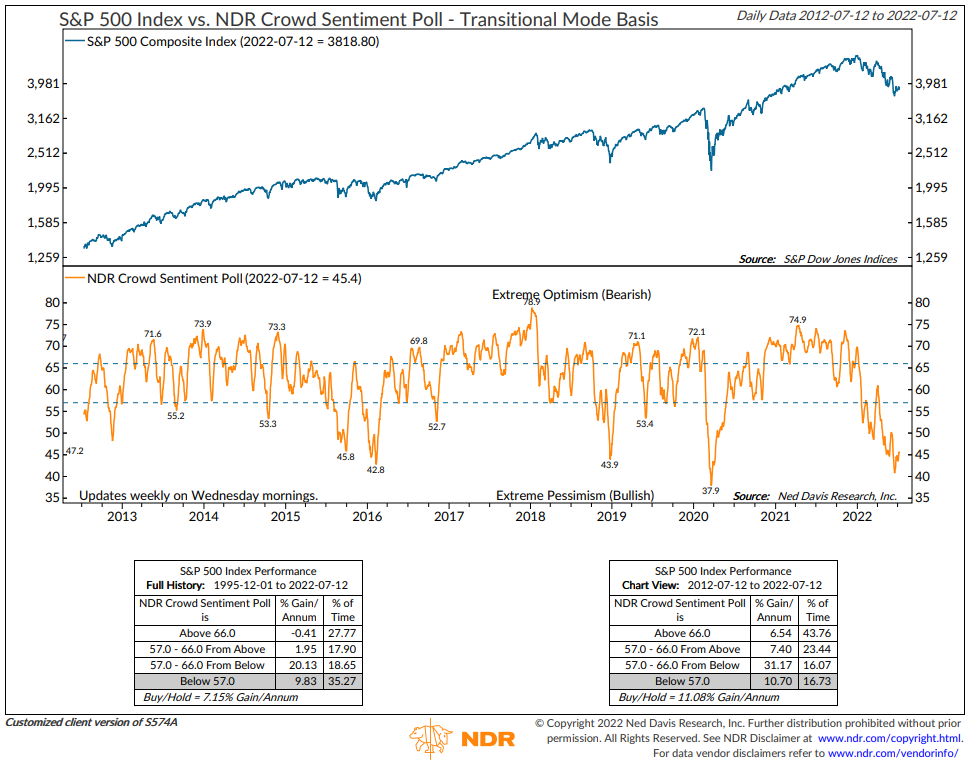

Bottom line, the markets have experienced numerous macro-and microeconomic headwinds through the first six months of the year, and they have legitimately pressured asset prices across stocks and bonds. But the sentiment is very negative at the moment, and a lot of potential “bad news” has been at least partially priced into stocks and bonds at these levels, again creating the opportunity for potential positive surprises.

Figure 3: S&P 500 Index vs. NDR Crowd Sentiment Poll.

To that point, the S&P 500 has declined more than 15% through the first six months of the year five previous times since 1932. And in all those instances, the S&P 500 registered a solidly positive return for the final six months of those years.

At Day Hagan Private Wealth, we understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this challenging investment environment. As the great investor Benjamin Graham so wisely said, “The essence of investment management is the management of risks, not the management of returns.” Our models continue to be cautious but will be quick to act should the message of the models point to a more bullish course.

Please do not hesitate to contact us with any questions, or comments, or to schedule a portfolio review.

Sincerely,

Regan Teague, CFA®, CFP®

Don Hagan, CFA®

Day Hagan Private Wealth

—Written 07.19.2022.

Print PDF Copy of the Article: Day Hagan Private Wealth Quarterly Market Update: Inflation, Rates, and Recession Risks Push Stocks and Bonds Lower in Q2 (pdf)

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Private Wealth (DHPW), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Private Wealth literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHPW accounts that DHPW or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member FINRA, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management and Day Hagan Private Wealth are both dbas of Donald L. Hagan, LLC.