PER STIRPES BENEFICIARIES

A COMMON STRATEGY

In many cases, our clients choose to designate basic primary and contingent beneficiaries (i.e., “no election”) on their retirement and transfer-on-death accounts. But what happens if one of your primary beneficiaries—for example, a son or daughter with children—predeceases you? Enter per stirpes.

Both per stirpes and the no-election method direct your assets if something happens to one or more of your beneficiaries. Where contingent beneficiary designations only come into play if none of your primary beneficiaries are still living, per stirpes addresses where the money goes if one or more, but not necessarily all, of your primary beneficiaries predecease you.

Let’s say you have three children: Adam, Betty, and Charlie. Adam and Charlie both have children, but Betty does not. In the following examples, we’ll examine how the different beneficiary choices work. The examples that follow assume you have not changed your beneficiary assignments to reflect the death of your beneficiary(ies).

Figure 1: Example family tree for our illustrations.

BASIC PRIMARY AND CONTINGENT BENEFICIARIES (NO ELECTION MADE)

As shown in the example on the right, let’s assume you want to leave equal shares of your assets to Adam, Betty, and Charlie (33.33%—Figure A1). However, if Adam predeceases you (and assuming you don’t update your beneficiaries), Betty and Charlie would equally split his share of the inheritance (an additional 16.67% for each of them, so that Betty would receive 50% and Charlie would receive 50%—Figure A2). Adam’s children are not taken into consideration.

If both Adam and Charlie predecease you, Betty would receive 100% of the inheritance as the only primary beneficiary (Figure A3).

Contingent beneficiaries only apply if all of your primary beneficiaries predecease you, and they would inherit according to the specifications you assigned to them. The rules of contingent beneficiaries follow those of the primary beneficiaries—if a contingent has passed away before you, the remaining contingent beneficiaries would equally split his or her share when you die.

Figure A: A tree showing the flow of inheritance using the basic “no election made” setup.

BENEFICIARIES WITH PER STIRPES

Per stirpes is an election intended to protect the lineal descent of inheritance. While the basic primary and contingent beneficiary designations do not take into account the children of beneficiaries, per stirpes makes sure that children are not left out if their beneficiary parent predeceases you.

For example, under per stirpes, if Adam passes away before you (again assuming you do not update your beneficiaries), his three children stand to inherit equal shares of his 33.33% (11.11% each—Figure B1). Betty and Charlie would still receive 33.33% when you pass away.

Figure B1: If Adam predeceases you, under per stirpes, his children would equally split his inheritance.

If Charlie also predeceases you, his two children would split his share (16.67% each—Figure B2).

Figure B2: If Adam and Charlie both predeceased you, Adam’s children would equally split his share of the inheritance, and Charlie’s children would equally split his share.

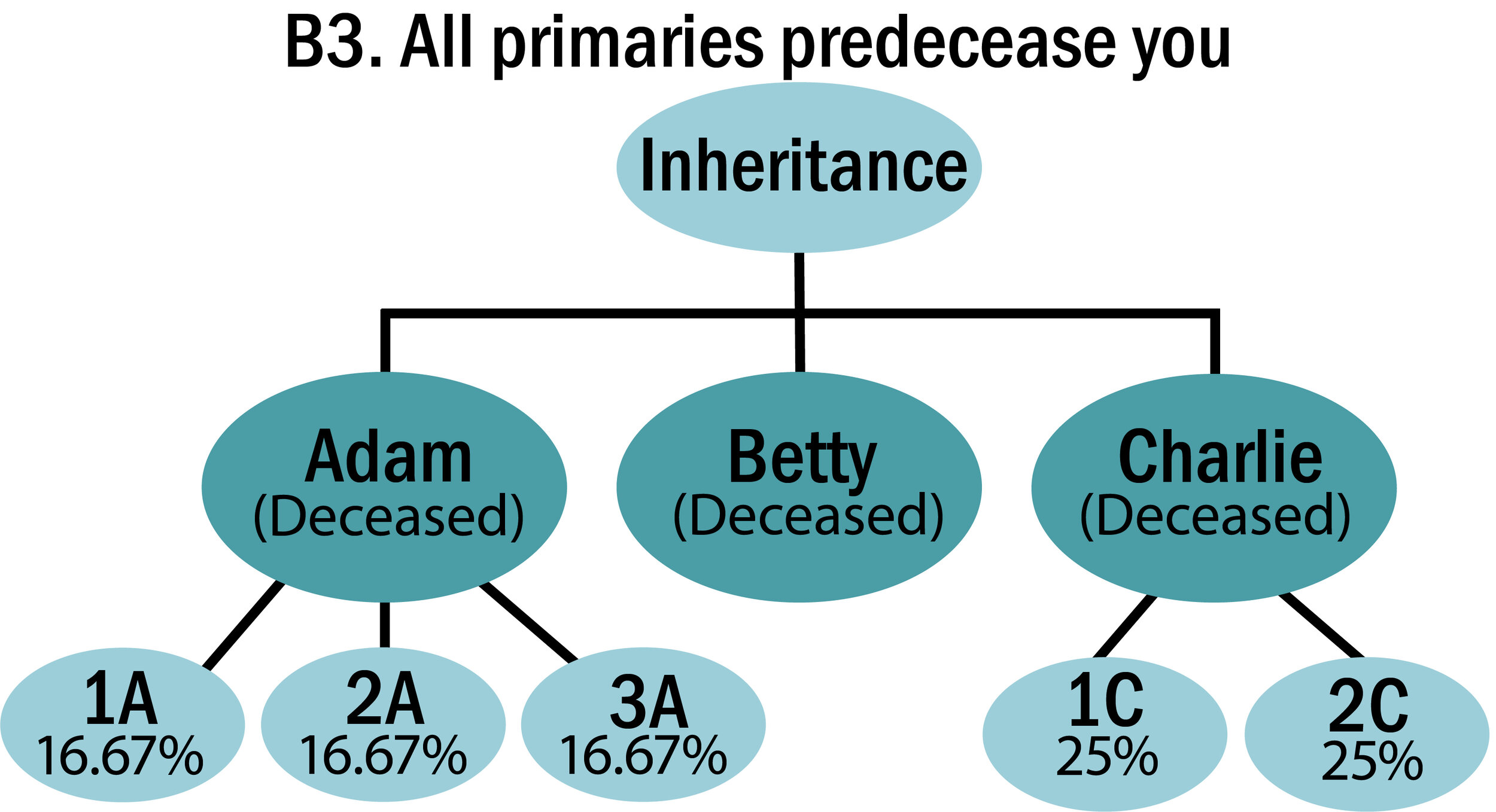

And if all three passed away before you, both Adam’s children and Charlie’s children would split half of Betty’s share. Adam’s children would each receive 16.67%, and each of Charlie’s children would receive 25% in total of the inheritance (Figure B3).

Figure B3: If Adam, Betty, and Charlie all predeceased you and you did not update your beneficiary designations to reflect this, Betty’s share of the inheritance would be equally split between Adam and Charlie, whose children would then equally split their respective shares upon your passing.

NOT THE ONLY OPTIONS

Just using the basic primary/contingent beneficiary designation or selecting per stirpes are not your only choices when it comes to assigning beneficiaries, but they are, at least in the case of retirement and transfer-on-death accounts, the most common designations chosen. Another alternative, per capita, can also be elected, and of course you can coordinate trusts, wills, and beneficiary designations to specify how your money will be distributed among your heirs. Be sure to consult an estate attorney if you have questions about appropriate strategies for your situation.

NOT FUN, BUT NECESSARY

It’s never fun to talk about, but choosing who gets your money when you pass away is important work. Making sure your beneficiaries are kept up to date with any new developments in your life or theirs is pivotal. Deaths, marriages, and divorces, among other things, can significantly change the direction in which you want your money to go at your death. At Day Hagan Private Wealth, we recommend reviewing your beneficiary assignments often, especially after any transition in your life. After all, beneficiary designations on retirement and transfer-on-death accounts supersede what is stated in your will, so it’s important to make sure your money is going where you want it to go. Call us any time to review your beneficiary designations on your accounts with us.

Best,

Natalie Brown, CFP®

Director of Client Services

Day Hagan Private Wealth

—Written 3.11.2021.

Print PDF Copy of the Article: Day Hagan Private Wealth Insights: Per Stirpes Beneficiaries (pdf)

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Private Wealth (DHPW), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Private Wealth literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHPW accounts that DHPW or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member FINRA, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management and Day Hagan Private Wealth are both dbas of Donald L. Hagan, LLC. None of the entities listed here in this disclosure are affiliated